Real Estate Market Trends USA 2025: Housing Prices, Mortgages, and Investments

The U.S. real estate market in 2025 is shaped by rising mortgage rates, housing supply shortages, and increased investor interest. For buyers and investors exploring real estate market trends USA 2025, housing prices USA 2025, and mortgage rates and property investment USA, understanding current trends is essential for making smart financial decisions.

Why the Real Estate Market Matters in 2025

- Housing Demand – Millennials and Gen Z are entering the housing market.

- Rising Mortgage Rates – Interest rates have shifted, affecting affordability.

- Limited Supply – Inventory shortages push housing prices upward.

- Investor Activity – More institutional investors buying residential properties.

- Regional Shifts – Cities like Austin, Phoenix, and Nashville are booming.

Key Market Indicators

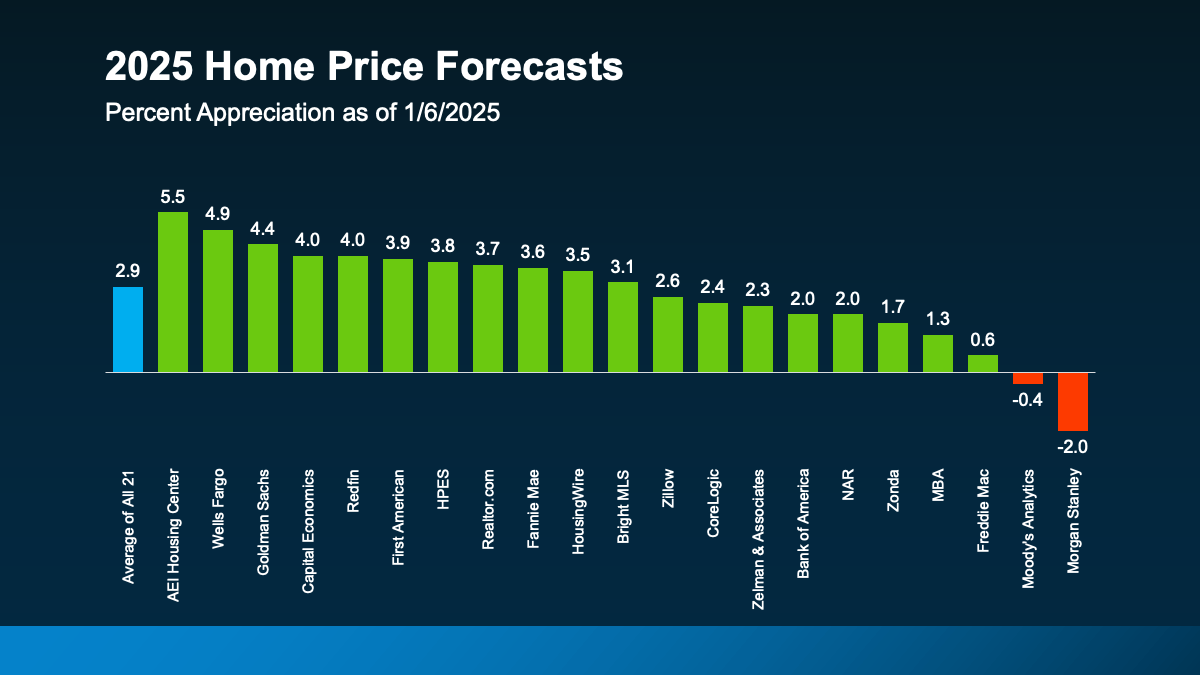

- Median Home Prices – U.S. median home prices reached record highs in early 2025.

- Mortgage Rates – Fixed-rate mortgages average around 6.5–7% in most states.

- Rental Market – Strong demand for rental housing due to affordability issues.

- Construction Trends – Builders focusing on multi-family and affordable housing projects.

- Foreign Investments – Continued growth from overseas buyers targeting U.S. markets.

Long-Tail Keywords in 2025

- real estate market trends USA 2025

- housing prices USA 2025

- mortgage rates and property investment USA

Case Study: Housing Prices in Texas

In 2025, Texas cities like Austin and Dallas experienced double-digit growth in home values. Median prices rose by 11% compared to 2024, reflecting both strong demand and limited supply. This underscores the importance of monitoring housing prices USA 2025.

Conclusion

The U.S. real estate market in 2025 is dynamic, with both challenges and opportunities for buyers and investors. Understanding real estate market trends USA 2025 is crucial for making profitable property decisions.

References

Coverage and Benefits of Real Estate Investments in USA 2025

The U.S. real estate market in 2025 covers diverse property types and offers significant benefits to buyers, homeowners, and investors. From residential homes to commercial buildings, the industry provides opportunities across regions. For those exploring real estate market trends USA 2025 or mortgage rates and property investment USA, the coverage extends to multiple sectors and financial models.

Who Does the Real Estate Market Cover?

- First-Time Buyers – Purchasing starter homes despite higher mortgage rates.

- Investors – Focusing on rental properties and long-term appreciation.

- Developers – Building multi-family units and mixed-use projects.

- International Buyers – Expanding into U.S. property for safe investments.

- Homeowners – Leveraging rising values for equity and refinancing options.

Main Benefits of Real Estate Investments in 2025

- Property Appreciation – Median housing prices rose by nearly 8% nationwide.

- Rental Income – High demand for rentals ensures steady cash flow.

- Hedge Against Inflation – Real estate remains one of the safest assets.

- Diversification – Investors balance portfolios with residential and commercial properties.

- Tax Advantages – Mortgage interest deductions and property tax benefits remain available.

Case Study: Investor in Phoenix

In 2025, an investor purchased a $400,000 rental property in Phoenix. With strong rental demand, the property generated $36,000 in annual rent, while its market value appreciated by 10% in a single year. This reflects the benefits of housing prices USA 2025 and smart property investments.

Why These Benefits Matter

Real estate remains a foundation of wealth creation in the U.S. For both local and foreign buyers, mortgage rates and property investment USA define affordability and profitability. Despite rising rates, property values and rental income ensure real estate remains a safe investment.

Conclusion

In 2025, the coverage and benefits of the U.S. real estate market extend to multiple buyer profiles and investment strategies. From appreciation and rental income to tax incentives, property continues to be a cornerstone of financial growth.

References

Step by Step Guide: How to Navigate the U.S. Real Estate Market 2025

For buyers and investors, navigating the U.S. real estate market in 2025 requires clear strategies to handle rising prices and evolving mortgage rates. Whether you are a first-time buyer or an international investor, following these steps ensures smarter decisions in real estate market trends USA 2025 and mortgage rates and property investment USA.

Step 1: Research Housing Prices

Track housing prices USA 2025 in key markets such as Austin, Phoenix, New York, and Miami. Use platforms like Zillow and Realtor.com for up-to-date market data.

Step 2: Assess Your Budget

Define affordability by considering mortgage rates, property taxes, and closing costs. Rising rates in 2025 require careful financial planning.

Step 3: Secure Financing

Compare fixed-rate and adjustable-rate mortgages. Work with lenders offering pre-approvals to strengthen your buying power.

Step 4: Work with Real Estate Agents

Licensed agents help buyers identify opportunities, negotiate deals, and avoid common mistakes. Many specialize in investment properties.

Step 5: Explore Rental Investments

With strong rental demand in 2025, investors should consider multi-family and short-term rental properties as part of a diversified portfolio.

Step 6: Inspect and Close

Ensure inspections cover property quality, safety, and zoning regulations before finalizing contracts. Closing with legal support reduces risks.

Case Study: Investor in Nashville

In 2025, an investor purchased a duplex in Nashville for $550,000. With monthly rent covering mortgage payments, the property appreciated 9% in value within a year. This case demonstrates the opportunities in mortgage rates and property investment USA.

Conclusion

By following a step-by-step approach, buyers and investors can successfully navigate the U.S. market in 2025. Research, financing, and smart property management ensure long-term real estate success.

References

The Future of U.S. Real Estate Market 2025–2030

Looking beyond 2025, the U.S. real estate market will continue evolving under economic, demographic, and technological forces. For buyers, homeowners, and investors exploring real estate market trends USA 2025, preparing for 2030 is essential to stay competitive in an ever-changing market.

Emerging Trends 2025–2030

- Smart Housing – Growth of AI-powered, energy-efficient homes.

- Urban Expansion – Rising demand in secondary cities like Austin, Raleigh, and Denver.

- Rental Boom – Increased rental demand due to affordability issues in home ownership.

- Global Buyers – More international investors targeting the U.S. for stable returns.

- Green Development – Sustainability becoming a requirement for new housing projects.

Technology’s Role

According to Deloitte Insights, by 2030 the real estate industry will integrate blockchain for transactions, virtual reality for property tours, and AI for pricing predictions. For mortgage rates and property investment USA, tech will drive faster, more transparent processes.

Challenges Ahead

- Affordability Crisis – Rising housing prices may keep ownership out of reach for many.

- Mortgage Rate Volatility – Interest rate fluctuations could impact buyer confidence.

- Climate Risks – Floods, wildfires, and storms threatening vulnerable housing markets.

Case Study: Green Housing Project in 2028

In 2028, a major developer launched a sustainable housing community in Colorado, powered by renewable energy and smart home systems. Properties sold out within weeks, proving the demand for eco-friendly and future-ready housing aligned with real estate market trends USA 2025.

Looking Toward 2030

By 2030, the U.S. housing market will emphasize affordability, sustainability, and technology-driven solutions. For investors following housing prices USA 2025, the next decade offers opportunities in rental housing, green developments, and tech-integrated real estate.