Smart Home Discounts: How Technology Lowers Your Home Insurance

Introduction

In 2025, smart home technology is doing more than just making life convenient—it’s also helping homeowners save money on insurance premiums. From smart security systems to water leak detectors, connected devices reduce risks of damage, theft, and accidents. Insurers reward this risk reduction with premium discounts.

This article explains how smart home technology works with insurance policies, the types of devices that qualify for discounts, real-world case studies, and how much you can save.

What Are Smart Home Discounts?

Definition and Purpose

Smart home discounts are insurance premium reductions offered to homeowners who install approved smart devices that mitigate risks. These discounts acknowledge that technology helps prevent costly claims, making both homeowners and insurers better protected.

Examples of Eligible Devices

- Smart Security Systems: Cameras, alarms, and motion sensors.

- Water Leak Detectors: Sensors that prevent water damage by shutting off supply lines.

- Smart Smoke & CO Detectors: Early warning systems reduce fire and health risks.

- Smart Locks: Prevent unauthorized access and reduce burglary claims.

- Connected Thermostats: Reduce risks of frozen pipes and fire hazards.

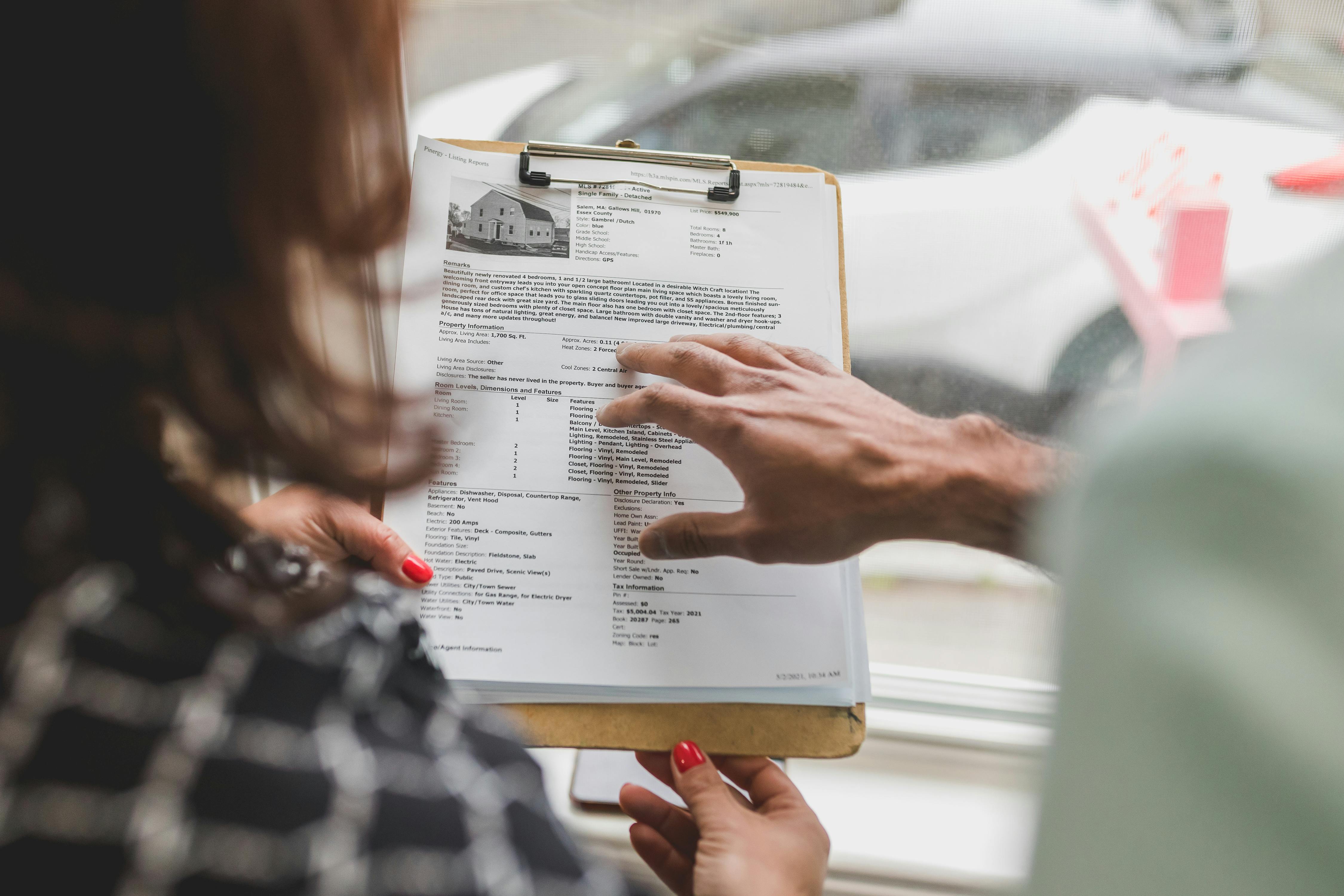

Case Example

A homeowner in Chicago installed a monitored smart security system in 2025. Their insurer offered a 10% premium discount, saving $250 annually on their policy. This shows how simple upgrades can translate into real financial benefits.

Why Smart Home Tech Matters for Insurers

Risk Reduction for Insurance Companies

Insurance companies base their premiums on risk probability. When homeowners install smart devices that reduce risks of theft, fire, or water damage, insurers face fewer claims and lower payouts. This allows them to pass savings back to customers through discounts.

Key Areas of Impact

- Security: Monitored alarms reduce burglary rates by up to 60%.

- Water Damage: Smart leak sensors can detect pipe bursts instantly, preventing thousands in damages.

- Fire Safety: Smart smoke detectors notify homeowners and emergency services in real-time.

- Liability Prevention: Smart locks and cameras discourage trespassing and vandalism.

Case Example

In 2025, one insurer reported that homes with smart leak detectors filed 40% fewer water damage claims. This statistic explains why insurers are eager to promote smart home adoption with premium discounts.

Key Benefits of Smart Home Discounts

Main Advantages

Smart home discounts offer more than financial savings—they create safer, more efficient, and stress-free households. Here are the top benefits for homeowners in 2025:

- Lower Premiums: Save 5–20% on annual insurance costs.

- Enhanced Safety: Protection from burglary, fire, and water damage.

- Energy Efficiency: Smart thermostats and devices reduce utility costs alongside insurance savings.

- Higher Property Value: Smart homes often sell faster and at better prices.

- Peace of Mind: Real-time monitoring ensures your home is always protected, even when you’re away.

Case Example

A family in Texas installed a full smart home system (security, leak detectors, and smart locks). Their insurer reduced premiums by 15%, saving $600 per year. They also benefited from lower energy bills and a safer living environment.

Types of Smart Devices That Qualify for Discounts

Smart Devices Eligible in 2025

Not every smart gadget will lower your insurance premium. Insurers typically provide discounts for devices that reduce the risk of damage or loss. The most common eligible technologies include:

- Smart Security Systems: Cameras, alarms, motion sensors, and 24/7 monitoring.

- Smart Smoke & CO Detectors: Immediate alerts prevent fire and carbon monoxide risks.

- Water Leak & Freeze Detectors: Shutoff valves stop water damage before it escalates.

- Smart Locks: Protect against burglary and unauthorized access.

- Connected Thermostats: Prevent frozen pipes and overheating risks.

- Smart Lighting: Motion-activated lights deter burglars.

Case Example

In 2025, a homeowner in Denver installed leak detectors and smart smoke alarms. Their insurer reduced premiums by 8%, saving $320 annually. These devices also prevented a major water leak that could have caused $15,000 in damage.

What Smart Home Discounts Do Not Cover

Exclusions in 2025

While smart home discounts can significantly lower premiums, there are important limitations. Not all devices or scenarios qualify for savings:

- Entertainment Devices: Smart TVs, speakers, and voice assistants usually don’t qualify.

- DIY Devices Without Monitoring: Insurers often require professional monitoring for maximum discounts.

- Cybersecurity Risks: Smart devices connected to the internet may introduce hacking risks, which aren’t covered.

- Wear and Tear: Insurance discounts don’t apply to normal maintenance issues.

- False Alarms: Some insurers exclude discounts if devices generate excessive false alerts.

Case Example

A homeowner in Florida installed a smart TV and a voice-controlled assistant, expecting discounts. Their insurer explained that only risk-reducing devices (security systems, smoke detectors, leak sensors) qualify for premium reductions.

Average Savings with Smart Home Discounts in 2025

Typical Savings

Homeowners in 2025 can save 5–20% annually on their insurance premiums by installing eligible smart devices. The exact amount depends on the insurer, device type, and level of monitoring.

- Basic Security System: 5–8% discount.

- Smart Smoke/CO Detectors: 5–10% discount.

- Leak and Freeze Sensors: 8–12% discount.

- Full Smart Home Package: Up to 20% discount.

On average, homeowners save between $150 and $600 per year depending on the size of the policy.

Case Example

A homeowner in New York installed a monitored security system and water leak sensors in 2025. Their insurer reduced premiums by 12%, saving $480 annually. Over five years, this amounted to nearly $2,500 in savings.

Factors That Affect Discount Amounts

Key Factors in 2025

The amount of savings you receive from smart home discounts depends on several important factors:

- Type of Device: Leak detectors and smoke alarms often lead to higher discounts than smart locks alone.

- Monitoring: Professionally monitored systems get larger discounts compared to self-monitored devices.

- Location: Homes in high-crime or high-risk weather zones may qualify for higher discounts.

- Insurer Policies: Each insurance company sets its own discount percentages and eligible devices.

- Bundled Systems: Installing multiple devices (security + leak + smoke detection) increases savings.

Case Example

In 2025, two homeowners installed smart security systems. One chose professional monitoring and saved 15% on premiums, while the other used self-monitoring and saved only 7%. This highlights the importance of system type and insurer rules.

Case Studies of Smart Home Discounts in Action

Case Study 1: Texas Homeowner

A homeowner in Dallas installed a monitored smart security system and water leak detectors in 2025. Their insurer applied a 15% premium discount, saving $550 annually. The leak detectors also prevented a burst pipe from causing $20,000 in water damage.

Case Study 2: Florida Condo Owner

A condo owner in Miami added smart smoke detectors and connected thermostats. Their insurer reduced premiums by 8%, and the thermostat helped prevent pipe freezing during a rare cold snap.

Case Study 3: New York Renter

A renter in Manhattan installed smart locks and a self-monitored camera system. Although the discount was smaller (5%), it still lowered her annual renters insurance by $80 while improving apartment security.

Final Thoughts and Recommendations

Key Takeaways

- Smart home devices reduce risks, leading to 5–20% insurance premium discounts.

- Security systems, leak detectors, and smoke alarms qualify for the largest savings.

- Professional monitoring often provides bigger discounts than self-monitored devices.

- Case studies show real financial benefits and risk prevention in 2025.

Recommendations

If you’re looking to save on insurance in 2025, focus on risk-prevention devices like monitored alarms, water leak detectors, and smoke sensors. Bundle multiple devices for maximum discounts, and always check with your insurer for specific eligibility requirements.