AI-Based Life Insurance Underwriting in 2025: The Future Is Here

In 2025, the world of life insurance looks nothing like it did just a decade ago. Artificial intelligence (AI) has stepped in as a silent yet powerful force — analyzing health data, lifestyle habits, and even wearable device metrics — to determine how much you pay and how fast you’re approved.

Gone are the days of waiting weeks for approval or answering endless health questions. With AI-driven systems, companies can now approve or reject applications within minutes — all while maintaining accuracy, fairness, and profitability. But how does this technology actually work behind the scenes?

In this article, we’ll explore how AI underwriting reshapes the life insurance landscape — from predictive analytics to the ethics behind algorithmic decision-making. Whether you’re a consumer, investor, or insurance professional, understanding this shift is essential to navigating the new world of digital insurance.

What Exactly Is AI Underwriting?

AI underwriting is the process of using machine learning and data science to evaluate a policy applicant’s risk profile. Instead of relying solely on medical exams and questionnaires, insurers now use algorithms that analyze:

- Electronic health records (EHRs)

- Wearable device data (heart rate, sleep, activity)

- Social and financial indicators

- Genetic predispositions (where allowed by law)

- Historical claim data

This approach doesn’t just make underwriting faster — it makes it smarter and more adaptive. Algorithms learn continuously, refining how they assess risk with every new data point.

Why 2025 Marks the Turning Point for AI in Life Insurance

The integration of AI into insurance has been decades in the making, but 2025 represents the first year where large-scale adoption is both affordable and trusted by regulators. Thanks to massive improvements in computing power, cloud data systems, and regulatory frameworks, insurers are finally confident in using AI models for high-stakes decisions.

Key Technological Drivers Behind This Revolution

- Wearable Health Data: Smartwatches like Apple Watch and Fitbit now provide insurers with real-time health data — heart rate variability, blood oxygen levels, and activity scores.

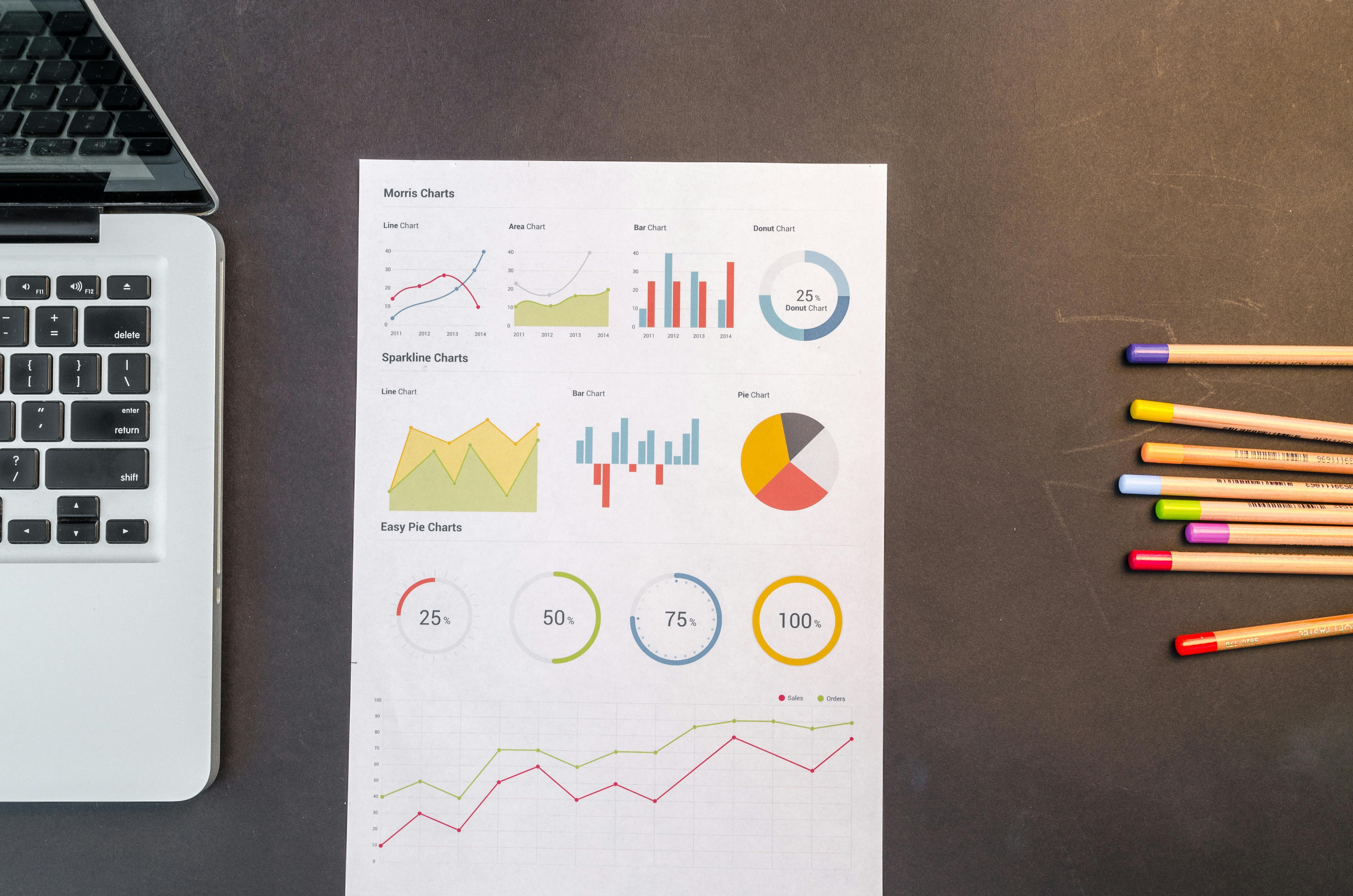

- Machine Learning Models: Predictive analytics help identify risk patterns from millions of anonymized policies.

- Natural Language Processing (NLP): AI can read doctor reports and unstructured medical documents faster than any human.

- Blockchain Integration: Ensures data transparency and prevents fraud in policy creation and claims.

What Does This Mean for Policyholders?

For policyholders, AI underwriting means faster decisions and personalized pricing. For example, a 35-year-old non-smoker who exercises regularly might receive a lower premium than someone with similar age but sedentary habits — even if their traditional medical test results look identical.

It’s a revolution not just in pricing, but in how fairness is defined. AI gives insurers the ability to treat every applicant as an individual rather than a statistic, rewarding proactive lifestyles and long-term health management.

In the next section, we’ll dive into how AI algorithms actually make these decisions — and whether they can be trusted to remain unbiased and ethical.

How Do AI Algorithms Actually Decide Your Life Insurance Premium?

When you apply for a life insurance policy in 2025, the decision-making process is handled by algorithms that can analyze thousands of variables in seconds. These algorithms work similarly to credit scoring systems — but they focus on health, lifestyle, and risk factors.

The Key Data Points Used by AI Systems

AI underwriting engines rely on structured and unstructured data. Here are the most common data sources used in 2025:

- Medical Data: EHRs, prescription history, and past procedures.

- Wearable Devices: Heart rate, sleep patterns, blood pressure, step count.

- Behavioral Data: Fitness app usage, social activity, even spending habits.

- Genetic Testing: In some regions, anonymized DNA reports predict long-term risk factors.

- Environmental Factors: Location-based health risks like pollution levels or access to healthcare.

How Machine Learning Models Work

Each data point is given a weighted score by the AI. Using predictive models, the system compares your profile to millions of anonymized datasets from past policyholders. Then it estimates the probability of a claim — this is how your premium is set.

Example: If your fitness tracker shows consistent activity and healthy sleep cycles, your “longevity score” increases, reducing your premium by 10–20%.

Transparency and Explainability

One of the major challenges in AI underwriting is transparency. Customers want to understand why their premium changed. To address this, leading insurers are adopting “Explainable AI” (XAI) — systems that provide clear reasons for every decision, such as:

- “Your physical activity level reduced in the last 3 months.”

- “Elevated heart rate data detected, increasing cardiovascular risk score.”

- “Consistent medical check-ups improved your long-term wellness rating.”

This transparency not only builds trust but also encourages policyholders to improve their health metrics actively.

Ethical Challenges and Hidden Biases in AI Underwriting

While AI can make life insurance more efficient and fair, it also introduces new ethical questions. Algorithms are only as unbiased as the data used to train them. If historical datasets contain social or economic biases, the results can unintentionally discriminate against certain groups.

Common Sources of Bias in AI Underwriting

- Socioeconomic Data: AI may unintentionally associate certain ZIP codes with higher mortality risk.

- Gender Bias: Historical data may reflect differences in male/female life expectancy unfairly.

- Healthcare Access: People from rural areas may appear riskier simply due to fewer hospitals nearby.

- Behavioral Assumptions: AI could overestimate risk for people with unique or nontraditional lifestyles.

How Insurers Are Tackling These Challenges

- Regulation: The U.S. Department of Insurance and EU regulators now require insurers to audit AI models regularly.

- Ethical Committees: Independent review boards monitor data sources and algorithmic decisions.

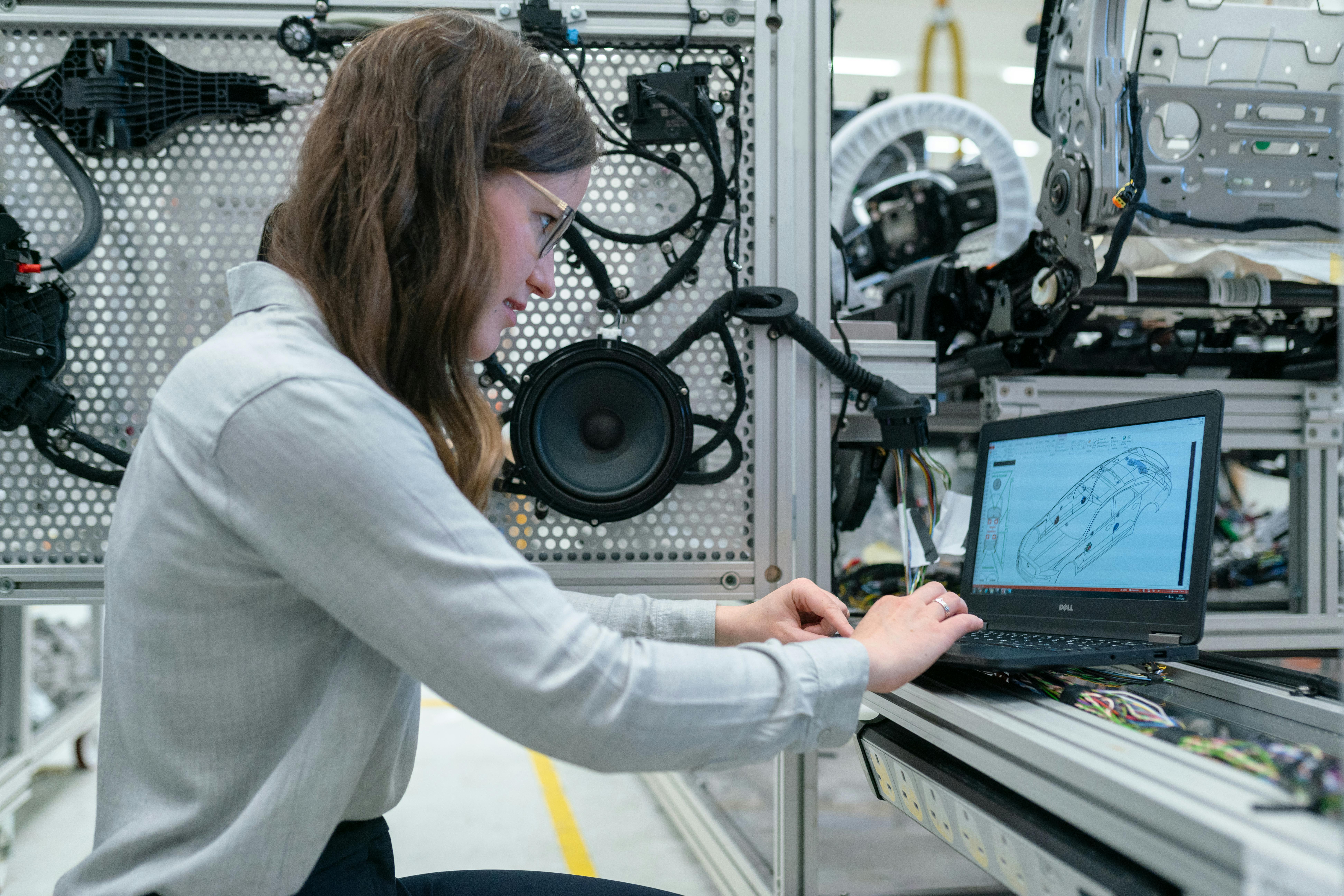

- Human Oversight: Every AI decision must be reviewable by human underwriters before final approval.

- Fairness Audits: External AI ethics firms test models for discrimination patterns annually.

These efforts are building the foundation of a new era in life insurance — one that combines the precision of machines with the ethics of human oversight.

Up next, we’ll explore how consumers can benefit directly from this new system and what steps to take to secure the best possible life insurance rates in 2025 and beyond.

The Real Benefits of AI-Powered Life Insurance for Consumers

AI isn’t just changing how insurance companies work — it’s transforming how you experience life insurance. The shift toward digital underwriting makes getting insured faster, fairer, and far more personal.

1. Instant Policy Approvals

With AI, the days of waiting for an underwriter to review your medical records are gone. Algorithms can process your application within minutes. For example, Prudential and Haven Life now use real-time predictive models that approve 70% of applicants instantly — without a medical exam.

2. Personalized Premiums

AI looks beyond age and gender. It measures your daily health behavior. That means you’re rewarded for walking 10,000 steps, eating healthy, or meditating regularly. The result? Cheaper premiums for people who invest in their well-being.

3. No More Human Error

Traditional underwriting relied heavily on human interpretation. AI eliminates mistakes caused by fatigue, bias, or misreading data. Every policyholder is judged by the same metrics — increasing fairness and trust.

4. Continuous Policy Updates

Unlike static policies of the past, AI policies evolve. If your health improves, your risk rating can be re-evaluated automatically. Some companies even offer cashback incentives for reaching certain health milestones.

5. Lower Administrative Costs

AI systems automate nearly 60% of manual insurance tasks, reducing operational costs by up to 30%. Those savings can translate directly into lower premiums for consumers.

In essence, AI doesn’t just make life insurance faster — it makes it smarter. It learns who you are, how you live, and adapts to your future.

Expert Tips: How to Choose the Best AI Life Insurance Policy in 2025

As the market floods with new AI-based insurance providers, picking the right one can be tricky. The following expert-backed steps will help you make the smartest decision.

1. Compare Transparency Levels

Not all AI insurers reveal how their algorithms work. Always choose companies that provide clear explanations about how they calculate your premium and what data they use.

2. Check Data Privacy Policies

Your data is valuable. Ensure your provider encrypts all personal information and complies with privacy laws like HIPAA and GDPR.

3. Look for Human Oversight

Even though AI handles the math, the best insurers have human reviewers for quality control. A balanced hybrid model ensures fairness and accuracy.

4. Evaluate Flexibility in Premium Adjustments

Some companies offer “dynamic premiums” that change with your health trends. This can work in your favor if you maintain a healthy lifestyle. Ask your insurer how often they reassess premiums.

5. Prioritize Established Insurers

New startups may offer attractive rates but lack stability. Trusted names like MetLife, Allianz, and John Hancock now integrate AI without compromising reliability.

6. Read User Reviews and Case Studies

Search online for customer experiences. Many users report savings of 20–30% when switching from traditional to AI-based insurers. However, watch for red flags like poor claim approval rates or hidden data-sharing practices.

In the next section, we’ll uncover real-world case studies — showing how AI helped families get better coverage, lower costs, and faster payouts in record time.

Real Case Studies: How AI Changed Life Insurance for Real People

AI isn’t just a buzzword — it’s already transforming how people access life insurance. Let’s look at three real-world stories that highlight how artificial intelligence is improving transparency, speed, and fairness in the industry.

📘 Case Study 1: Emma’s Instant Approval

Emma, a 32-year-old software engineer from Austin, Texas, wanted life insurance but hated the long wait times. She tried an AI-based insurer offering instant underwriting. By linking her Fitbit and health app, the algorithm processed her fitness and medical data instantly. Her approval came in 90 seconds — no blood test, no paperwork.

Result: Emma saved $180 per year compared to traditional insurers, simply because her AI-generated wellness profile rated her “low-risk.”

📗 Case Study 2: Mike’s Dynamic Premium Adjustment

Mike, a 45-year-old father of three, switched to a dynamic AI policy that adjusted rates quarterly. After losing 20 pounds and improving his heart rate, the AI reclassified him as “fit,” reducing his monthly premium by 25%.

Result: Over two years, Mike saved nearly $600, motivating him to maintain his new healthy habits.

📙 Case Study 3: Linda’s Transparency Journey

Linda, a 60-year-old retiree, was skeptical about AI. But when her insurer introduced a transparent AI dashboard showing how her premiums were calculated — she changed her mind. She discovered her rates were based mostly on her blood pressure and lifestyle, not age.

Result: Her trust increased, and she stayed loyal to the same insurer for 5+ years.

These stories reveal one truth: AI isn’t replacing humans — it’s helping insurers serve customers more efficiently and fairly than ever before.

Common Mistakes People Make When Buying AI-Based Life Insurance

Even though AI-powered insurance systems are designed to simplify things, many buyers still make avoidable mistakes that cost them time and money. Here are the most common ones — and how to avoid them.

❌ Mistake #1: Ignoring Data Privacy Policies

Some people connect their wearable devices without checking how their data will be used. Always review the privacy policy — especially if the insurer shares anonymized data with third-party research firms.

❌ Mistake #2: Assuming AI Is Always Cheaper

AI-based plans aren’t always the cheapest. If your health metrics are inconsistent, algorithms may classify you as higher risk. Compare traditional and AI-based quotes before deciding.

❌ Mistake #3: Not Updating Health Data

AI models rely on continuous data. If you stop syncing your smartwatch or health apps, the system might base premiums on outdated information.

❌ Mistake #4: Choosing Startups Without Track Records

Many new AI insurers appear every year — but not all are stable. Always verify company credentials, claim settlement ratios, and financial strength before trusting your policy with them.

✅ Bonus Tip: Combine AI with Human Support

The best strategy is to choose insurers that blend both — automated decisions with human advisors available for complex cases. This hybrid model ensures fairness, empathy, and accountability.

By avoiding these pitfalls, you’ll enjoy the full potential of AI-powered life insurance — smarter premiums, faster claims, and total transparency.

The Future of AI in Life Insurance: What to Expect in 2026 and Beyond

The insurance industry is on the edge of a massive digital transformation. What started as automated underwriting is evolving into full AI-driven ecosystems — where health, lifestyle, and even emotional well-being shape your financial protection.

🔹 Predictive Health Management

Future life insurance won’t just protect you after something happens — it will actively help you prevent risks. Imagine your policy alerting you when your heart rate trends suggest fatigue or stress. Companies like John Hancock Vitality already reward healthy habits with discounts and perks. By 2026, this will become the standard.

🔹 AI-Powered Claim Processing

Currently, most claims still take days or weeks to settle. In the next phase, AI claim bots will verify documents, cross-check medical data, and issue payments within minutes — creating a smoother, stress-free experience for families during difficult times.

🔹 Ethical AI Governance

Global regulators are now prioritizing AI ethics and fairness. Expect new international standards that require transparency reports and annual AI audits to prevent bias or unfair pricing.

🔹 Integration with Digital Health Platforms

By 2027, your life insurance may sync directly with your Apple Health, Google Fit, or hospital EHRs. Real-time data sharing ensures up-to-date risk assessment and personalized rewards — creating a fully connected health-finance ecosystem.

🔹 Rise of Emotionally Intelligent AI

Next-gen AI will not only analyze health data but also emotional tone — identifying stress, burnout, or mental wellness patterns. This emotional intelligence can tailor coverage, providing mental health resources or crisis support proactively.

These innovations point toward one thing: Life insurance in 2030 won’t just be about death benefits — it’ll be about living better, longer, and healthier.

Conclusion: Why You Should Explore AI-Based Life Insurance Today

The future of life insurance is already here — driven by data, powered by AI, and built around you. Whether you’re a young professional, a parent, or nearing retirement, AI-based life insurance offers:

- 💡 Faster approvals without paperwork

- 💪 Personalized rates based on real health, not stereotypes

- 🔍 Transparency through explainable algorithms

- 💰 Long-term savings through dynamic premium adjustments

Take Action Now

Don’t wait for the future — it’s already happening. Compare top AI-based life insurance companies in the USA today:

- Haven Life – Instant approval with real-time health data sync.

- Ladder Life – Adjustable policies you can scale anytime.

- John Hancock Vitality – Earn discounts for living healthy.

Before choosing, check transparency, claim ratios, and privacy standards. A 15-minute review could save you hundreds — or even thousands — over your policy’s lifetime.

Final Thought

In a world where algorithms are shaping finance, healthcare, and risk — choosing the right AI-driven insurer is one of the smartest financial moves you can make in 2025. Empower yourself with data, embrace technology, and protect your future with confidence.

💬 Ready to find your perfect AI-powered life insurance?

Explore trusted U.S. providers today — and start saving smarter, not harder.